“I have four young girls of my own, and I’ve enjoyed a close affiliation with their school having been the Home and School Treasurer for four years. I’ve come to understand the trials, difficulties, and challenges that schools face, and the lack of funds they have to provide the resources they want for their students. That’s where we can really help – stretching that dollar a little bit further, so Kiwi kids can get the best education possible.”

– Ben Duflou - Director, Accounting For Schools

Latest News

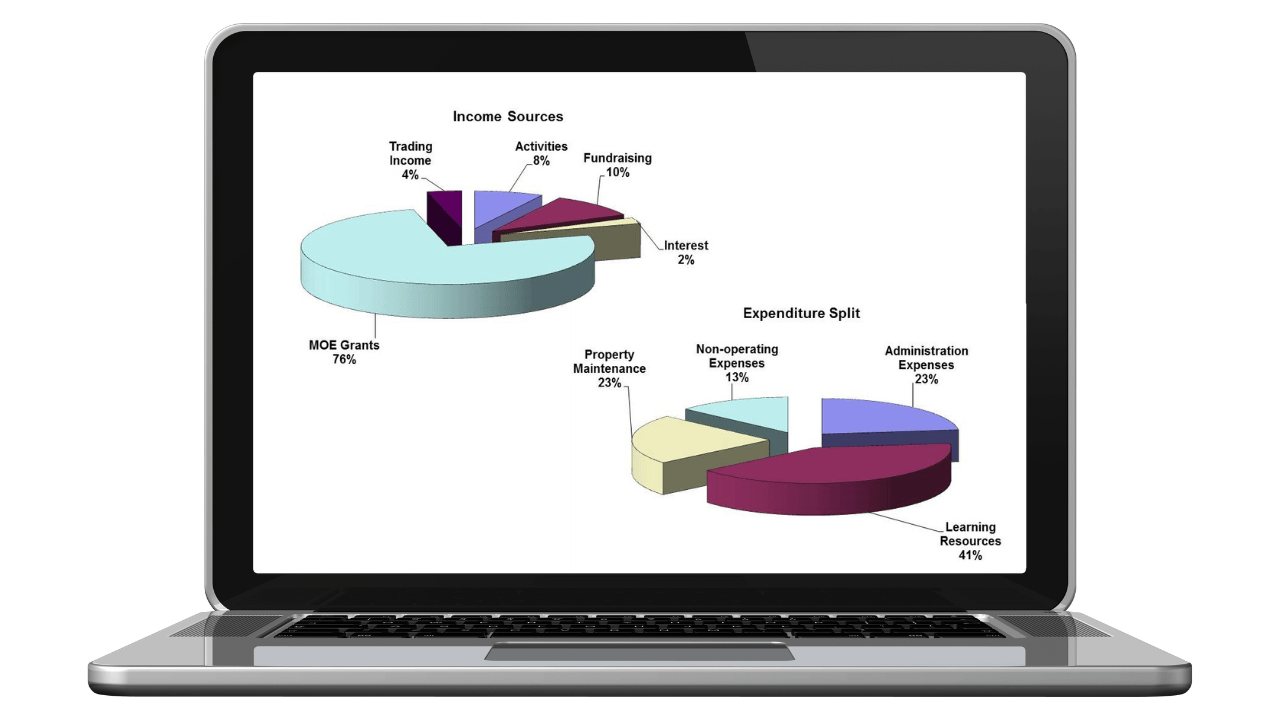

Financial risk is an unavoidable part of running any school. Unexpected expenses, changes in funding, or compliance challenges can have a significant impact if not identified and managed early. Proactively managing these risks is key to protecting your school’s financial sustainability and ensuring your resources remain focused on students’ learning and wellbeing. The following key areas outline practical steps schools can take to identify, manage, and reduce financial risk in a structured and effective way. 1. Identify Key Financial Risks: Understanding where your school may be exposed is the first step. Common risks include: Dependence on a single or limited funding source Budget overruns or inaccurate forecasting Cashflow pressures during the year Fraud, error, or misuse of funds Non-compliance with reporting or audit requirements Regular review by the Board and finance team helps ensure potential issues are identified early. 2. Budgeting and Forecasting: A realistic, well-planned budget is one of the most effective tools for managing financial risk. Reviewing actual results against your budget throughout the year highlights discrepancies early, allowing you to take corrective action before problems escalate. Scenario planning, such as modelling the impact of reduced funding or unexpected costs, can help you prepare for uncertainty. 3. Cashflow Management and Reserves: Monitoring cashflow ensures that you can meet your obligations at all times. Maintaining adequate reserves provides a buffer against unexpected costs or delays in funding, helping your school operate smoothly even during challenging periods. 4. Internal Controls: Strong internal controls reduce the risk of error, fraud, and mismanagement. Key practices include: Clear delegation of financial authority Separation of duties for approvals and payments Regular reconciliation and review processes Transparent reporting to the Board Documented policies and procedures also help maintain consistency, particularly during staff changes. 5. Compliance and Reporting: Staying up to date with Ministry requirements, audit obligations, and other regulatory changes is essential. Accurate and timely reporting not only ensures compliance but also supports informed decision-making by your Board. 6. Planning for Uncertainty: Embedding risk awareness into everyday financial practices prepares you for unexpected events. Scenario planning, regular review of policies, and maintaining contingency funds all help reduce surprises and enable confident decision-making. Managing financial risk is a core part of good school governance. By identifying risks early, maintaining strong controls, and planning for uncertainty, you can protect your school’s financial position and continue focusing on providing high-quality education for your students.

View our Chalkboard - February 2026: - 2025 Annual Accounts - Important Notices - 2025 Notional Lease Figures Now Available - Xero Tip of the Month: Review Your Repeating Bills - Managing Risk in School Finances: Protecting Your School’s Future - Looking ahead https://public2.bomamarketing.com/email/ZLV6

At the start of the school year, it’s a good idea to review your repeating bills in Xero to ensure they’re still accurate and up to date. Repeating bills are often created once and then left running in the background. Over time, amounts may change, services may no longer be required, or accounts may need updating. If they aren't reviewed, outdated repeating bills can lead to incorrect expenses and inaccurate reporting early in the year. Taking a few minutes now to check your repeating bills helps keep your financial information accurate and reduces the need for corrections later. For those who need a reminder, you can find your repeating bills under Purchases > Bills > Repeating and update or stop any that are no longer needed.